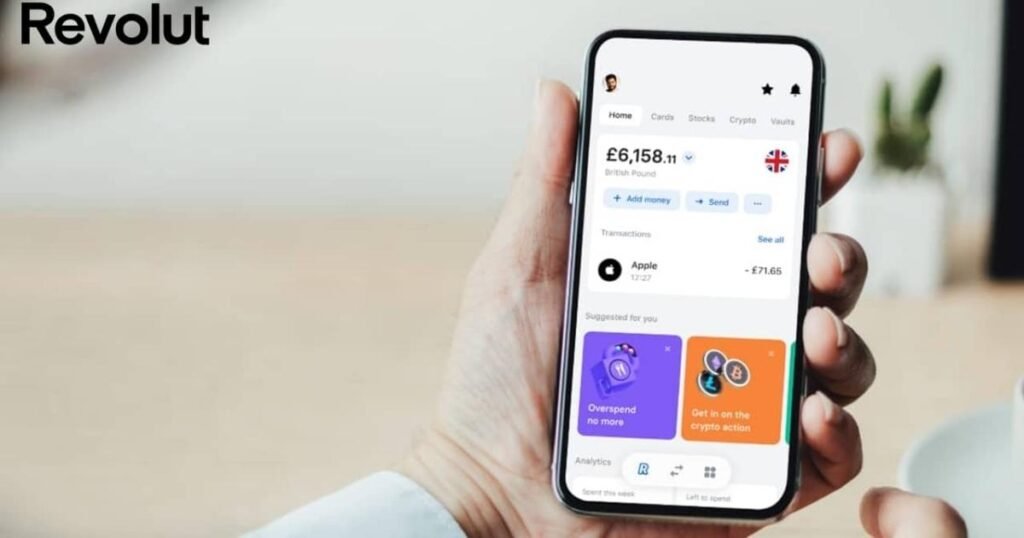

When it comes to international travel or managing money in multiple currencies, Revolut has become a popular choice due to its competitive exchange rates and ease of use. However, understanding Revolut exchange rate fees is essential to maximizing your currency exchanges and avoiding unexpected costs. Here’s a comprehensive look at what you should know before using Revolut for currency exchanges.

What Are Revolut Exchange Rate Fees?

Revolut offers currency exchange services at interbank rates, which are generally better than those provided by traditional banks or currency exchange services. However, fees can apply in specific circumstances, especially for standard (free) account holders or during certain times. Knowing when fees apply and how they work is crucial to getting the best possible rates.

Revolut Exchange Rates Explained

Revolut primarily uses the interbank exchange rate, which is the rate banks use to exchange currencies among themselves. For many users, especially travelers and expatriates, Revolut’s interbank rate offers a significant advantage over traditional bank and currency exchange rates.

However, Revolut applies markups and fees depending on the account level, time of exchange, and the currency being exchanged. Here’s a breakdown of when Revolut exchange rate fees might apply:

- Weekend Fees

Revolut typically applies a markup of 0.5% to 1.5% on currency exchanges performed over the weekend, as currency markets are closed, and the company accounts for potential shifts when markets reopen. The exact markup can vary by currency:- Major currencies (like USD, EUR, GBP): Weekend markup is typically 0.5%.

- Less common currencies: A markup of up to 1.5% may apply.

- Standard vs. Premium and Metal Accounts

Revolut offers three main account types: Standard (free), Premium, and Metal. The Standard account includes free currency exchanges up to a specific monthly limit. After that, a fee of 0.5% applies to additional exchanges. Premium and Metal accounts come with higher or unlimited exchange limits, making them beneficial for frequent travelers or those who need to exchange larger amounts. - Monthly Exchange Limits for Standard Accounts

Standard users can exchange currency at the interbank rate up to a limit of £1,000 (or equivalent) per month without fees. Beyond this limit, Revolut charges a 0.5% fee on each transaction. - International Transfers and Hidden Costs

International money transfers within Revolut are often free, but fees may apply when sending money outside the Revolut network or in a different currency. While Revolut doesn’t charge for receiving funds, banks involved in international transfers might. It’s essential to be aware of these potential intermediary bank fees, as they’re outside Revolut’s control.

Tips to Avoid or Minimize Revolut Exchange Rate Fees

With a few strategic steps, you can make the most of Revolut’s favorable rates and minimize fees:

- Exchange on Weekdays: To avoid weekend markups, try to make currency exchanges from Monday to Friday when possible.

- Upgrade Your Account: For users who frequently exchange large amounts, upgrading to Premium or Metal can help avoid the 0.5% fee that applies after the £1,000 limit on Standard accounts.

- Monitor Currency Trends: Currency values fluctuate, so timing your exchanges when rates are favorable can lead to better value.

- Consider Timing for Transfers: Avoid weekend transfers if possible, as these may incur higher fees.

Pros and Cons of Revolut Exchange Rate Fees

Understanding the benefits and limitations of Revolut’s fees can help you decide if it’s the right service for your currency needs.

Pros:

- Access to Interbank Rates: Revolut provides highly competitive exchange rates, generally better than those from traditional banks.

- Flexibility Across Currencies: With over 150 currencies supported, Revolut covers a broad range of needs for international travelers and expats.

- Upgraded Account Benefits: Premium and Metal accounts offer higher exchange limits and additional perks, such as free ATM withdrawals and travel insurance.

Cons:

- Weekend Markups: Extra fees apply on weekends, making timing essential to avoid these costs.

- Standard Account Limits: For frequent exchangers, the £1,000 monthly limit on the Standard account may feel restrictive.

Is Revolut Right for Your Currency Exchange Needs?

Revolut exchange rate fees can be minimal if you’re mindful of when and how much you exchange. For those who frequently travel, manage multiple currencies, or make international purchases, Revolut’s rates and flexibility can be a great advantage. Premium and Metal accounts can be worthwhile for heavy users, offering better value for higher monthly exchange limits and other perks.

However, understanding the structure of Revolut’s fees, especially weekend markups and monthly limits for standard users, will ensure you get the best possible value. As long as you’re aware of these factors, Revolut can be a powerful tool for making the most of your money across borders.